Business Portfolio Approach

Fujikura Kasei has introduced the business portfolio approach from the 11th mid-term management plan.

In all our business segments̶the coatings for plastics, architectural coatings, electronic materials, functional polymers/polymers & resins, and synthetic resins businesses̶we will“ identify social issues and ascertain the values we can provide” and strive to achieve our targets and sustainable growth of our businesses.

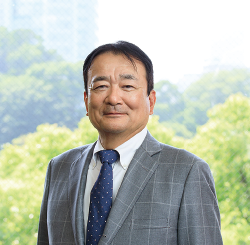

Coatings for Plastics

Basic policy for value creation

Executive Director and

General Manager of the

Coatings for Plastics Division

Hitoshi Kawaguchi

Business overview and value creation policy

Overview, features, and strengths

The coatings for plastics business is a pioneer in its field, providing coating materials with excellent design and functionality for diverse sectors and leading the industry in Japan and overseas. In the automobile market, we have gained a significant global market share and high trust in our car interior and exterior products. In other markets as well, we offer a wide range of products that satisfy diverse needs, such as coatings for cosmetics containers and films.

Review of the first year of the 11th mid-term management plan

As a basic policy for value creation in the coatings for plastics business, we are committed to pursuing functions and creating value needed to address environmental changes and the challenges accompanying the transition to a decarbonized society. We are also working to provide value worldwide through our extensive global network and advance our technologies and services at a pace that exceeds changes in the external environment. In the first year of the 11th mid-term management plan, we faced a difficult market environment, particularly in China. However, we successfully raised awareness of our eco-friendly and decarbonization products, such as biomass products, plating alternatives, and films, primarily in Japan. Additionally, thanks to new demands for our products, we have laid the groundwork for growth for the next fiscal year and beyond.

FY2024 initiatives and FY2025 objectives

This fiscal year, we will concentrate on making products for less CO₂ emissions our core products by continuing our initiatives from last year to expand our lineup of water-borne and biomass products while further promoting the sales of products for plating alternatives and film applications and proposing energy-saving solutions by streamlining processes such as low-temperature, short-time baking. Additionally, we will continue to evolve and strengthen our global network to provide seamless value worldwide. Furthermore, as we approach fiscal 2025, the final year of the 11th mid-term management plan, we will respond to rapid changes in the supply chain and mobility environments through the sustainable creation and provision of new value.By leveraging the technical synergies of our global network, we will advance the development of the next generation of decarbonization and eco-friendly products, which will allow us to address the challenges faced by users in various regions worldwide and contribute to solving social issues and realizing a carbon-neutral society.

Policies under the mid-term management plan

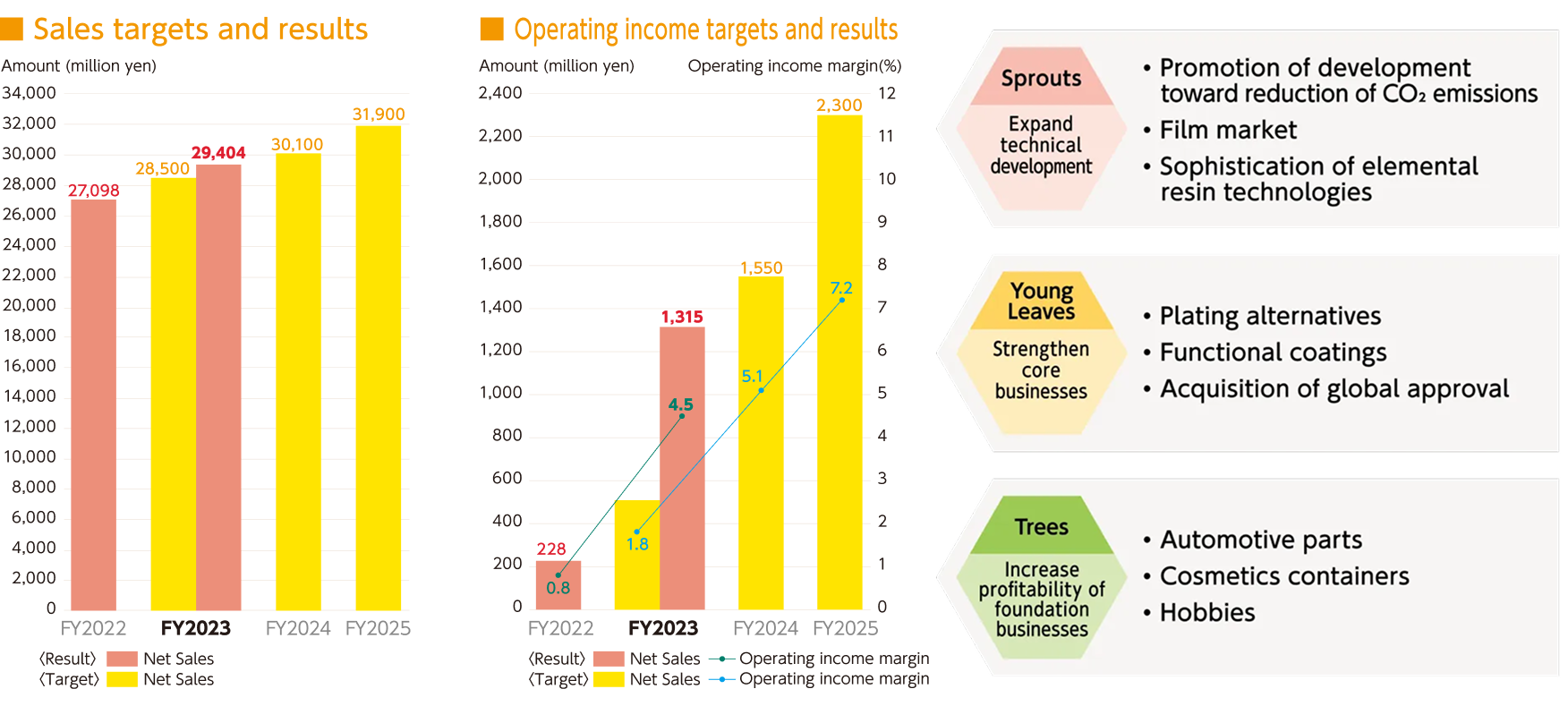

Architectural Coatings

Basic policy for value creation

Senior Vice President and

General Manager of the

Architectural Coatings Division

Hisashi Kajiwara

Business overview and value creation policy

Overview, features, and strengths

The architectural coatings business is centered on architectural coatings for residential houses. Dedicated coatings and specifications are customized for each housing manufacturer, to deliver values such as high durability, functionality, and design. In the area of coatings for the renovation sector, our Group company provides high-quality construction under a manufacturer-responsible construction system.

Review of the first year of the 11th mid-term management plan

In fiscal 2023, we engaged in product design from two approaches—“materials development with a long-term perspective up to the coating work stage” and “construction based on thorough knowledge of materials”—and successfully launched a high-quality, highly hydrophilic (ultra-low dirt accumulation) top coat with excellent workability. The stable workability of this top coat brings out the full potential of coatings and has allowed us to provide stable, ultra-low contamination performance as a new value.

Toward the realization of decarbonization, we have embarked on developing products made from naturally-derived materials to minimize our reliance on energy-intensive raw materials and reduce environmental burden. In addition, as our contribution to addressing the social issue of aging infrastructure, we have created the basic design for a new coating by using the technologies and experience we have accumulated to date through the development and production of coatings for residential houses.

FY2024 initiatives and FY2025 objectives

Toward fiscal 2025, we will continue our development efforts for realizing sustainable product manufacturing. We will explore the commercialization of the naturally derived carbon-neutral raw materials we have been working on and assess their usability by comparing their performance with synthetic materials. Our goal is to contribute as much as possible to reducing CO₂ emissions. Additionally, we will pursue the launch of coatings that address the social issue of aging infrastructure, along with the utilization of waste materials and the development of coatings with longer life and higher functions.

To promote safety, quality, and efficiency in applying coatings, we will nurture sales and application personnel by holding regular training and information sessions in cooperation with our Group companies. We will aim to update and enhance their knowledge to ensure the transfer of know-how and appropriate responses to a changing social environment.

Policies under the mid-term management plan

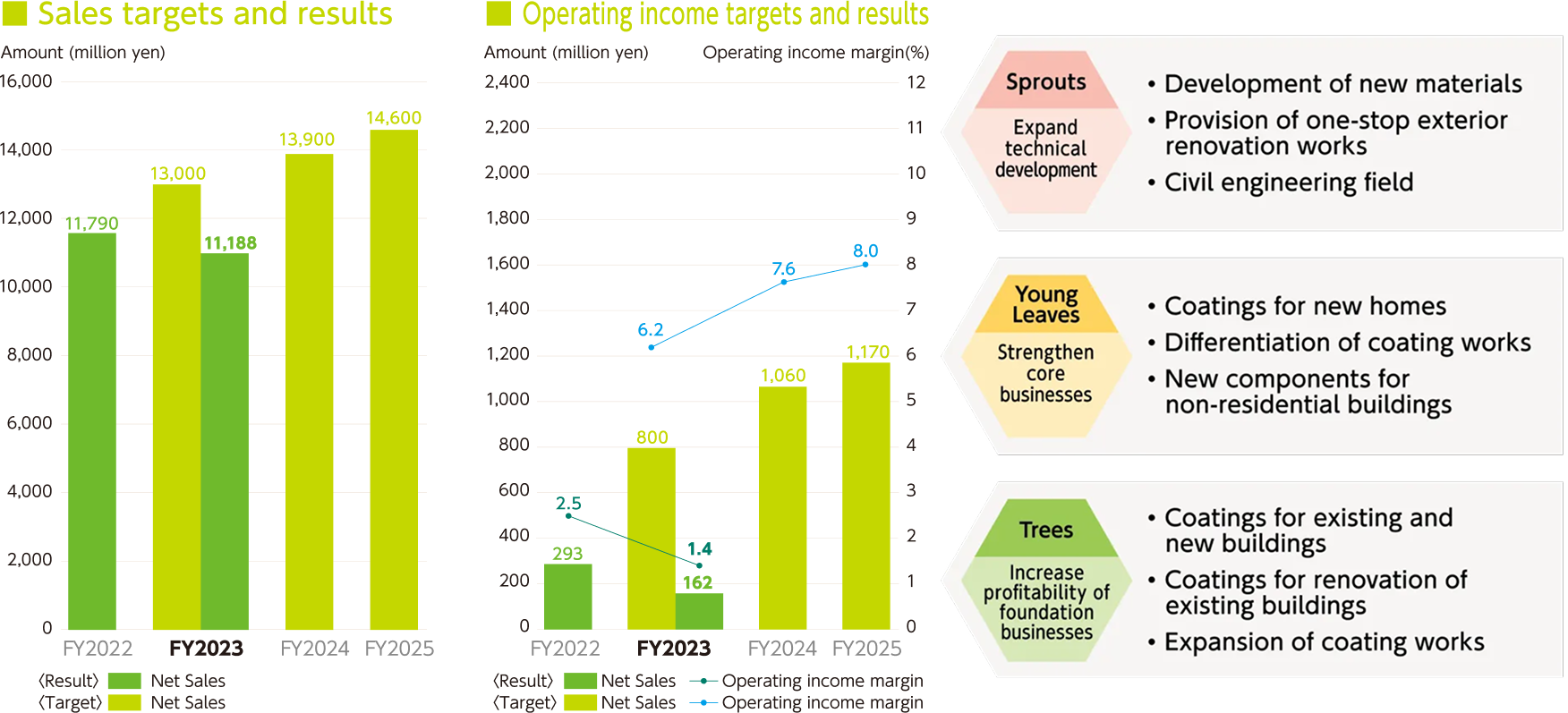

Electronics Materials

Basic policy for value creation

Executive Director and

General Manager of the

Electronic Materials Division

Takahiro Ishii

Business overview and value creation policy

Overview, features, and strengths

In 1957, the electronic materials business marketed the electroconductive resin DotiteTM which it jointly developed with the Electrical Communication Laboratory of Nippon Telegraph and Telephone Public Corporation (now NTT) and succeeded in industrializing for the first time in Japan. For more 60 years thereafter, we have served and contributed to people's lives and industries as a pioneer in step with the growth of the electronics industry.

Review of the first year of the 11th mid-term management plan

In the electronic materials business, we have identified the “next-generation automobile industry,” “information communications industry,” and “healthcare industry” as priority fields in anticipation of our business environment in 2030. We are advancing our business in these fields with our sights on the Society 5.0 concept proposed by the Cabinet Office as the future vision of society.

In the automobile industry, our electroconductive polymer has been adopted as a conductive adhesive for capacitors in response to the demand for high-reliability control and sensor components which has increased with the dissemination of advanced driving systems. We are now developing a silver paste for use in MLCC resin external electrodes in collaboration with our customer.

In the information communications industry, we developed high-conductivity shielding products for package-level use as our contribution to IoT-based high-speed communications and infrastructure. These shielding products are compact, thin, and lightweight, allowing for high-integration substrates. In the future, we will propose solutions to address the challenges faced by the market and our customers. Additionally, toward realizing a carbon-neutral society, we have developed and launched a water-borne conductive paste that cures at room temperature. It has been adopted by many of our customers as a product that reduces the use of environmentally harmful substances.

FY2024 initiatives and FY2025 objectives

As our contribution to remote sensing and wearable devices in the healthcare industry, we are working in cooperation with our customers to commercialize a stretchable conductive paste for healthcare sensor applications. By adopting wiring materials that maintain durability even when stretched, we hope to commercialize the product in sensor applications that require stretchability.

Since silver powder is the primary raw material for products in the electronic materials business, we will continue to focus on conserving natural resources and developing resource-saving products. We will also engage in the development and promotion of Dotite® as a product that will continue to help address social issues.

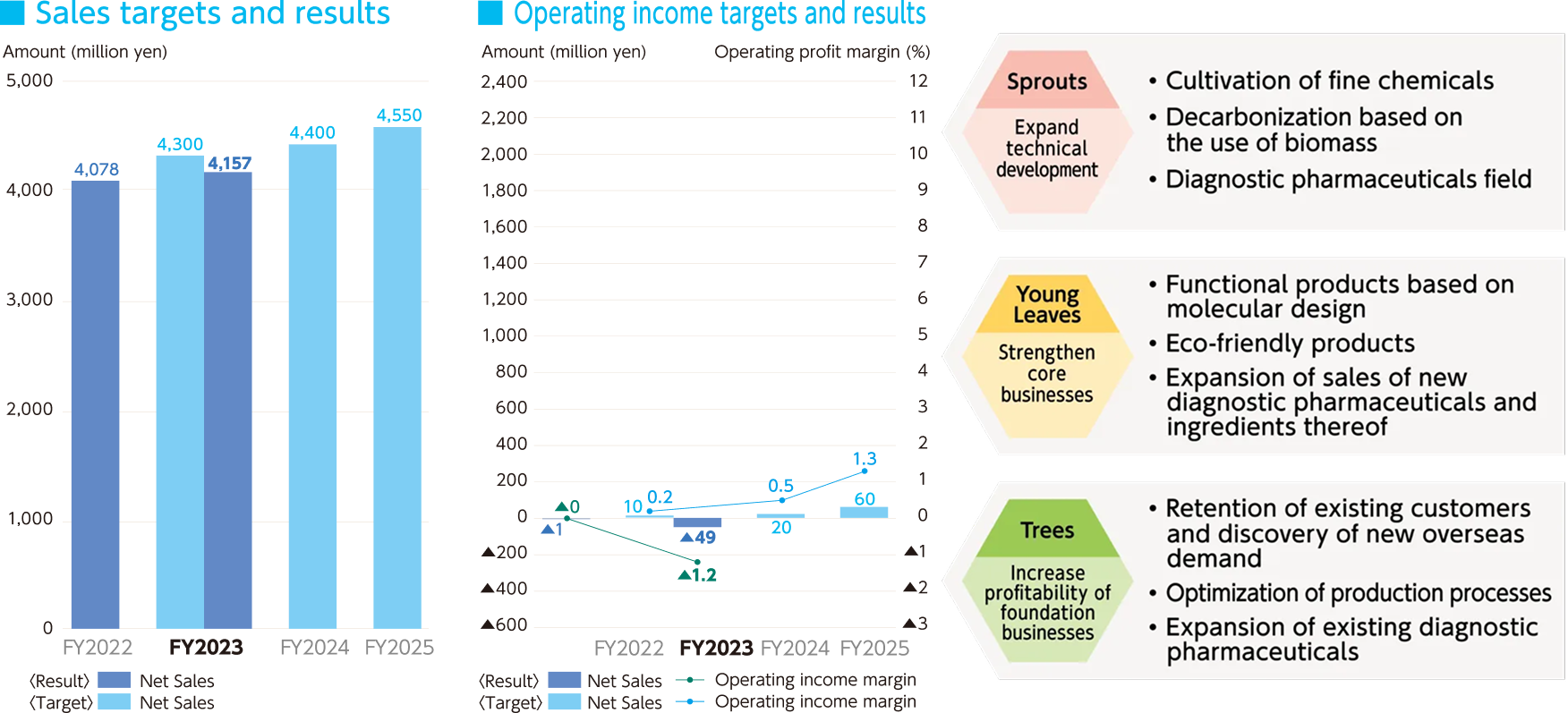

Policies under the mid-term management plan

Functional polymers / polymers & resins

Basic policy for value creation

Executive Director and

General Manager of the

Functional Polymers/Polymers

& Resins Division

Satoshi Watanabe

Business overview and value creation policy

Overview, features, and strengths

The functional polymers/polymers & resins business is aiming to expand in new fields such as fine materials, high-function polymers, sintered resins, and new in vitro diagnostic pharmaceuticals and materials. In each field, we will develop products that satisfy customer needs and respond to their trust by leveraging technologies we have cultivated to date, including suspension microparticle technology, high-performance emulsion synthesis technology, urethane synthesis technology, triblock technology, and UV technology. In the medical materials department, we have developed latex reagents that incorporate polymer properties and advanced into the field of in vitro diagnostic pharmaceuticals for diabetes and rheumatoid arthritis. These products are helping to improve people's daily lives in inconspicuous ways.

Review of the first year of the 11th mid-term management plan

Our fine materials have made advances in new areas within the urethane field. With respect to organic microparticles and high-performance emulsions, we are working to commercialize them by proposing solutions to customer needs.

In the area of high-performance polymers and sintered resins, we have seen an expansion of products that use triblock and UV technologies in addition to an expansion of our existing customer base. We are steadily increasing our performance toward achieving the targets of the 11th mid-term management plan.

In the diagnostic pharmaceuticals area, diabetes test reagents have grown particularly in emerging countries. Anticipating a global increase in diabetes patients, we will continue our efforts to promote a healthy and comfortable life for all.

FY2024 initiatives and FY2025 objectives

We are committed to taking an aggressive approach to reach our sales target for the final year of the 11th mid-term management plan. Focusing on the “Sprouts” and “Young Trees” areas, we will concentrate our efforts on fine materials and new adhesives.

In addition, we will promote the development of new products using innovative technologies to expand our existing market and explore new ones, always keeping in mind that our performance in fiscal 2024 is directly linked to achieving the targets for the final year of the 11th mid-term management plan.

Policies under the mid-term management plan

Synthetic Resin

Basic policy for value creation

Tohkoh Jushi Co., Ltd.

President

Manabu Ikegami

Business overview and value creation policy

Overview, features, and strengths

The synthetic resins business is undertaken by Tohkoh Jushi Co., Ltd. (founded in 1964), a trading company specializing in the sale of raw materials and plastic sheets, films, and processed products. We do not simply supply products to customers, but we also enga ge in fine-tuned sales and follow-up activities. For example, we provide product developme nt information based on the management and sales strategies of our customers, introduce new materials and products, and make project proposals from the selection of raw materials to product sales.

Review of the first year of the 11th mid-term management plan

In fiscal 2023, we strengthened communication with our customers, actively exploring and selling synthetic resins in addition to products tailored to address customer issues, and thus created new business opportunities. For overseas customers, we set our sights on products that receive continuous orders and collaborated with manufacturers to make joint product proposals, achieving a result that would lead to good sales performance in fiscal 2024. Additionally, as part of our efforts to explore new markets, we began handling imported goods and succeeded in acquiring new customers. Our achievements in fiscal 2023 have expanded our customer base and diversified our business, laying the foundation for further growth in the future. We will keep watching market trends as a specialized trading company and strive to make proactive proposals to our customers.

FY2024 initiatives and FY2025 objectives

In fiscal 2024, we are leveraging our group's bases in Asia and the U.S. to expand our raw materials trade overseas. Domestically, we are expanding processing operations within our supply chain in Japan to mitigate the impacts of exchange rate fluctuations. We are also working to ensure a stable supply of materials for lithium-ion batteries to respond to the rapid advances in the electrification market. Furthermore, we took the occasion of the reorganization of the petrochemical industry to build new supply chains and uncover new demand with the aim of providing new value. Based on these initiatives, we intend to pursue sustainable growth and expand our business in fiscal 2025.

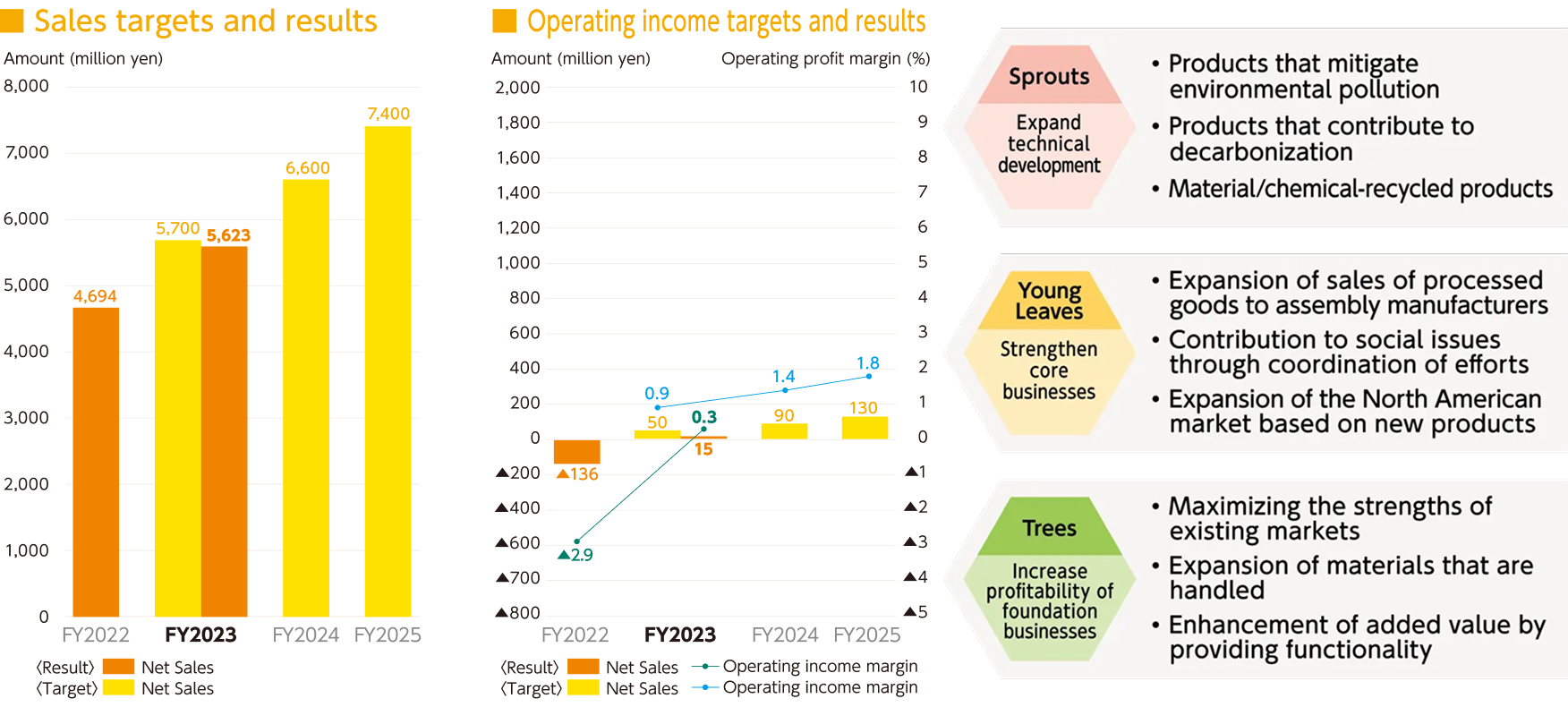

Policies under the mid-term management plan

Production

Basic policy for value creation

Executive Director and

Director of Sano Plant

Masahiro Takano

Business overview and value creation policy

Features and strengths

Fujikura Kasei’s production department has kept in step with market changes an d diverse customer needs from its flagship Sano Plant and production bases in and outside of Japan. Always with priority on safety, our company produces diverse products under a sophisticated quality control system, including coating materials, architectural coatings, conductive pastes, and acrylic resins. To ensure proper manufacturing work and quality value from the customer perspective, various management system certifications have been acquired, nam ely ISO 9001, IATF 16949 (electronic materials division), ISO 13485 (medical materials d epartment), ISO 14001, and ISO 45001.

Review of the first year of the 11th mid-term management plan

Quality manufacturing cannot be achieved by our company alone. The cooperation of diverse business partners, including raw materials manufacturers and partner companies, is indispensable. In the production area, we focused our fiscal 2023 efforts on improving logistics efficiency with the cooperation of our partner companies in anticipation of the “2024 problem” accompanying work style reform laws. We also concentrated on strengthening safety, quality, and human resource development. To create a workplace environment where employees can work comfortably, we implemented activities aimed at preventing human errors in addition to pointing-and-calling awareness activities and successfully reduced the occurrence of human errors. Additionally, to strengthen human resource development, we held regular “1-on-1 meetings” to foster employee engagement through dialogue and realize their well-being.

FY2024 initiatives and FY2025 objectives

In fiscal 2024 and onward, we will make ongoing efforts to promote logistics efficiency to meet our delivery commitments to our customers while working to reduce the logistics cost ratio relative to sales amounts. To strengthen safety, quality, and human resource development, we will continue to make timely and proactive capital investments based on an accurate grasp of market changes to enhance safety, ensure stable factory operations, and advance factory automation and digitization. Through the above, we will aim to improve production efficiency while continuing our initiatives to promote employee well-being.

Policies under the mid-term management plan