Mid-term Management Plan and Sustainability

Fujikura Kasei identified the year 2030 as a long-term milestone and launched the 11th mid-term management plan in April 2023 as the first step toward that goal.

With the support of all our stakeholders, we will make steady steps toward our future vision.

Moving forward to realize our “future vision” in line with the 11th mid-term management plan

We defined our 2030 vision as a company that “provide new value through co-creation × evolution × power of chemistry” This vision embodies our wish to “provide sustainable value through co-creation with stakeholders,”“ achieve evolution with technologies and services that surpass the speed of change,” and“ keep up with environmental changes and contribute to social issues through chemistry.” Following the launch of the 11th mid-term management plan in A pril 2023 as our first step toward achieving our long-term goal, we w ill move forward to realize our future vision.

Executive Director and

General Manager of

Administration Headquarters

Susumu Kurihara

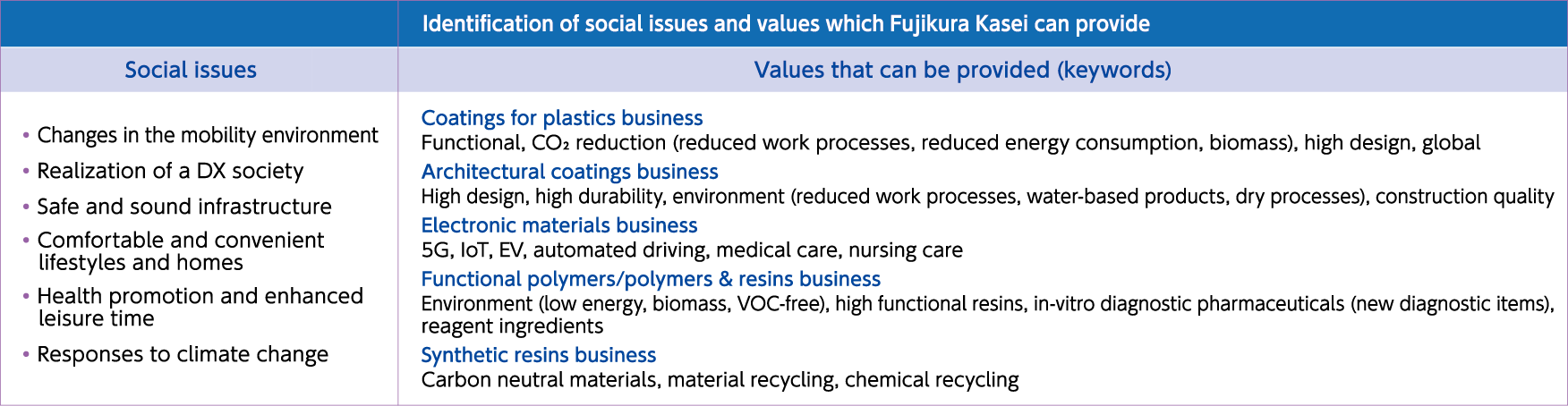

Identification of social issues and values which Fujikura Kasei can provide

Based on the awareness that realizing our 2030 vision is direct ly related to addressing social issues through our businesses, we first identified relevant social issues and contemplated what values we can provide through each of our five business segments with regard to those issues.

By deriving our future direction from the values we can provide through our five business segments, we will push forward initiatives that ride on our company ’s strengths based on the 11th mid-term management plan.

11th mid-term management plan“ Creating a New Vision for the Next Generation”

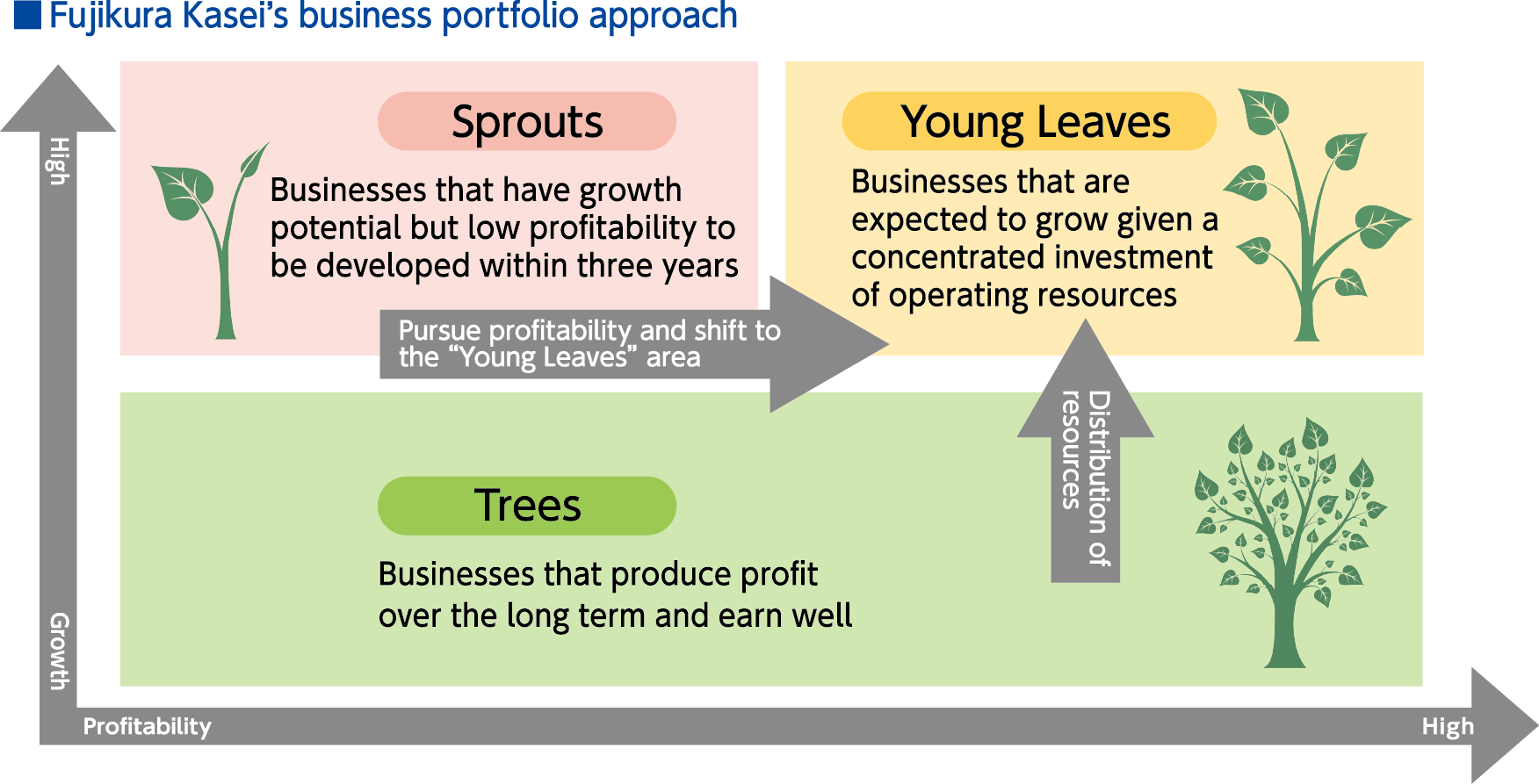

In the 11th mid-term management plan, we set forth the basic policy of“ creating a new vision for the next generation.” Based on this policy, we have formulated three strategies in the business area and two strategies in the management area also within the plan, and will pursue them through company-wide efforts as our five strategies for sustainable growth.

The three strategies in the business area include “Sprouts: Expand technical development,”“ Young Leaves: Strengthen core businesses,” and“ Trees: Expand the profitability of foundation businesses.” The business portfolio approach was introduced and these strategies were placed along the two axes of“ profitability” and“ growth.”

Our five business segments will carry out their business portfolio strategy by dividing the business areas and products they each handle into three areas. Their respective efforts to continuously create new value and promote a renewal of our business content will lead to sustainable growth.

The two strategies in the management area are “sustainability initiatives” and “resilient management foundation.” In April 2023, we established a Sustainability Committee and are taking initiatives with the awareness that sustainability is an important management issue. In addition to our CSR activities to date, we will also pursue efforts to solve social issues through our businesses so w e may ultimately a chieve sustainable growth. Additionally, with an eye to making our management foundation more resilient, we will promote DX as suited to the operations of each department and support their responses to changes and sustainable growth.

Furthermore, in addition to information about our achievements and business strategies, we will also proactively disclose non-financial information, to enhance our disclosure of information to all stakeholders.

人的資本経営の重要施策

1. 人材育成

2024年度に人材育成をはじめとした人的資本の考えの構築を進め、事業ポートフォリオの推進とワークエンゲージメントの向上を目指します。当社は従業員同士が繋がる文化を強みとし、「挑戦を後押しする社風」「多様な考えを受け入れる風土」があり、相互理解と成長を促し、イノベーションを生み出す組織基盤を構築していきます。

2. ダイバーシティ&インクルージョン

多様性がイノベーションを生む土壌となると考えており、女性活躍、シニア活躍、障がい者活躍を推進します。多様な人材が活躍するには多様な働き方に柔軟に対応するため、制度整備をはじめとした両立支援の施策と職場へのフォロー体制を構築していきます。

3. エンゲージメント

エンゲージメントサーベイを実施し、組織が従業員の働きがいを理解し、効果的な職場環境を構築しているかを確認しています。従業員の声から現状を客観的に把握することで、改善すべきポイントを明確化していきます。また、経営理念を積極的に浸透させる活動を展開しており、経営理念に共感し行動することで、従業員のモチベーション向上や組織の一体感を促進しています。

その他、定期的なフィードバック面談をはじめとした上長との面談制度、自己申告面談をはじめとした人事部門との面談制度から従業員の能力や志向を把握し、組織全体のパフォーマンス向上に繋げています。

Implementation of the business portfolio approach and a capital efficiency-oriented management

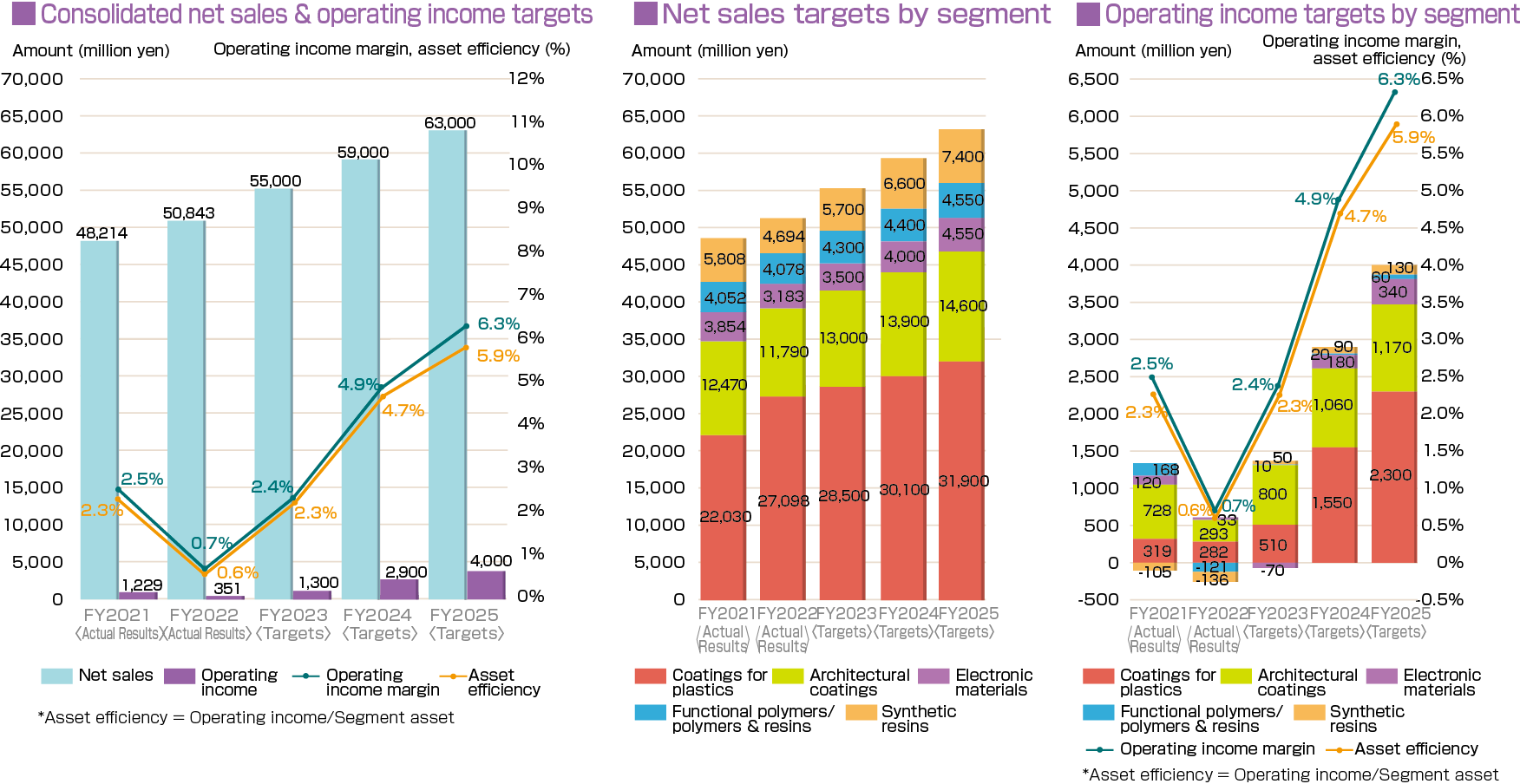

In line with the growth strategy that is based on the respectiv e business portfolio of our five business segments, the Fujikura Kasei Group aims to achieve 63 billion yen in sales and 4 billion yen in operating profit by the final fiscal year of the 11 th mid-term management plan. We will aim to realize this goal by executing three strategies in the business area and two strategies in the management area.

Executive Director and

Deputy General Manager of

Administration Headquarters

Toyohiro Tsuchiya

資本収益性を重視した経営のポイント

1. 資本コストの把握

効果的な資本配分や投資判断を行うため、資本コストの把握を目指し、経営の意思決定に繋げるための基盤とします。経営の意思決定においては、資本コストの正確な把握が企業価値の最適化やリスク管理に直結すると考えています。また、投資判断や資本配分の基準として資本コストを活用し、効率的な経営戦略を展開し、持続的な成長と競争力強化に繋げていきます。

2. 株主還元と資本政策

第11次中期経営計画期間中「総還元性向70%以上を目指す(配当16円以上は維持)」としています。事業ポートフォリオの推進とともに資本収益性を意識した取り組みから、企業価値の向上を目指していきます。

3. 「気候関連財務情報開示タスクフォース(TCFD)」について

当社は気候変動問題を重要課題のひとつとして挙げていおり、2023年5月にTCFDへ賛同しました。TCFD提言に基づいたシナリオ

分析については、詳しくはこちらをご覧ください。

Profit plan in the 11th mid-term management plan

Firstly, priority will be placed on the early recovery of our Group’s performance that has been on the decline over the past few years.

Raw material prices are surging, but we will strive to improve profitability by ensuring fair purchase and sales prices on the premise of providing stable supplies to our customers. The “Trees” area of the business portfolio will play an important role in the recovery of our immediate business performance. As such, we will focus on improving the earnings structure of all our operations.

With respect to making new investments in the“ Sprouts” and“ Young Leaves” areas as a growth strategy, we will ascertain not only growth potential but also the efficiency of invested capital in quantitative terms so we may establish an optimal business portfolio and ultimately enhance our corporate value.

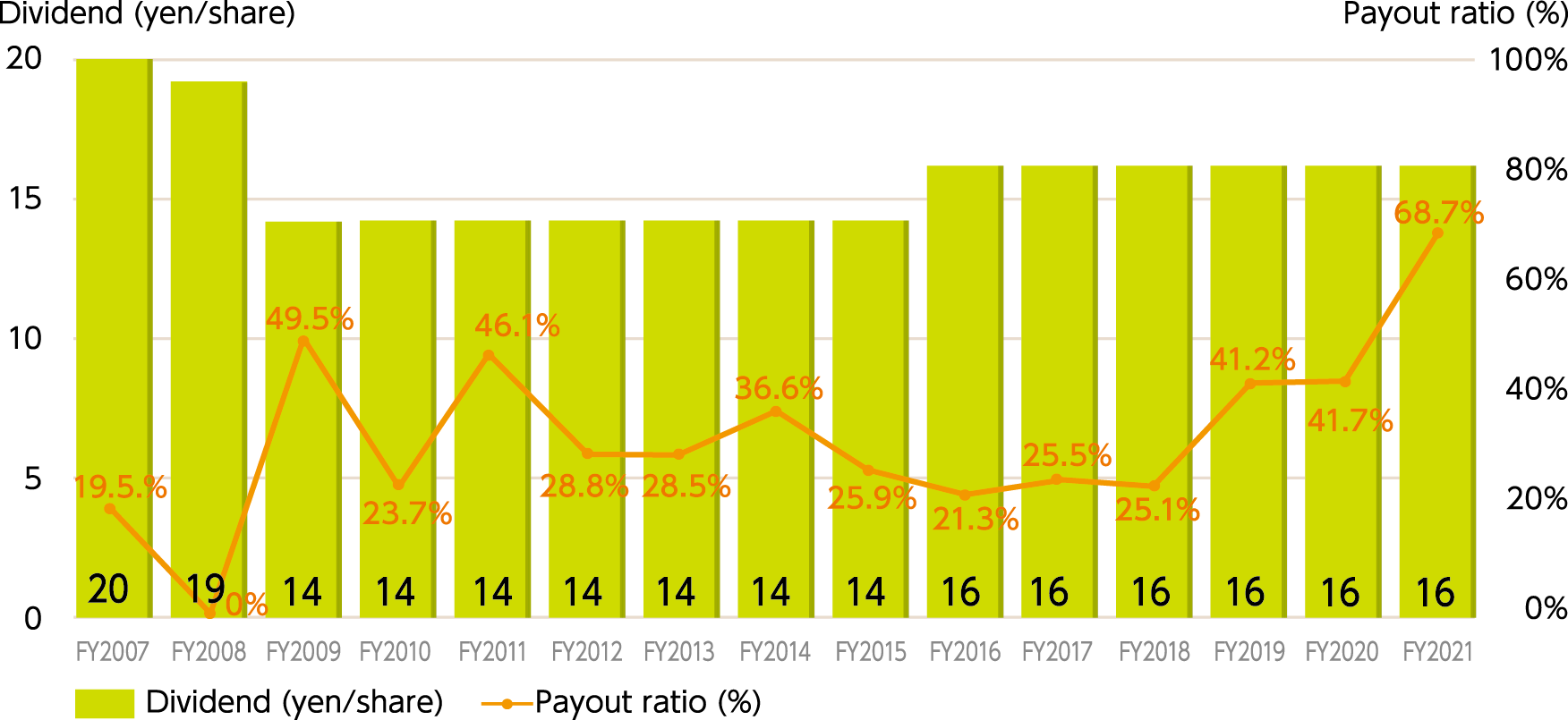

Shareholder return and capital policy

The 11th mid-term management plan sets forth specific numerical targets for shareholder return and capital policy. By pursuing these targets, we will aim to enhance our corporate value.

At Fujikura Kasei, we believe it is important to realize sustainable shareholder return not only by focusing on capital efficiency but also by making active investment toward future growth and by considering the proper weight of investment in ensuring safe and stable supply, which is our primary responsibility as a manufacturer.

policy

- Aim to achieve an ROE of 8% or more

- Acquire treasury shares in a timely manner

return

- Aim for a total return ratio of 70% or more during

the period of the 11th mid-term management plan

(maintain a dividend of 16 yen or more)