Corporate Governance

In the investment field, the term ESG is commonly used as a collective concept, but we regard E (environment) and S (society) as being on an equal level and G (governance) as the foundation upon which E and S activities are implemented. We are committed to developing an even stronger governance framework, to engage in activities as one with the aim of promoting co-existence and co-prosperity between all employees and society and chieving sustainable growth.

Our basic concept of corporate governance

We regard corporate governance as a priority management issue, and engage in various policies to increase business efficiency, promote prompt decision-making, and strengthen the supervisory function of management. We will also act on our basic internal control policy to balance efficiency and control toward increasing corporate value and to aim to create internal controls appropriate to our company.

Our corporate control framework

(1) Board of Directors

Our Board of Directors is composed of 8 directors, 2 outside directors and 4 directors who are Audit and Supervisory Committee members. As decision-making bodies, the Board of Directors and the Executive Committee discuss, deliberate, and decide on company-wide management issues.

Additionally, a business executive meeting composed of directors and department managers is held regularly every month to promote effective business management.

(2) Audit and Supervisory Committee

Pursuant to the Companies Act, we have installed an Audit and Supervisory Committee. It is composed of four Audit and Supervisory Committee members, including three outside directors.

(3)Nomination and Remuneration Committee

We have a Nomination and Remuneration Committee in place that serves as an arbitrary advisory body to the Board of Directors.

The committee is composed of three members that include one inside director and two outside directors.

The committee is composed of three members that include one inside director and two outside directors.

In 2024, the committee convened in February and April to formulate and submit draft recommendations to the board of directors. The recommendations pertained to candidate directors and other board members for the following year, and to individual remunerations including the performance-based remuneration for directors, among others.

FY2023 initiatives

(1) Reduction of cross-shareholdings

As we did last year, we reviewed our cross-shareholdings, such as whether our reason for owning them is appropriate and whether their benefits and risks measure up to their capital cost in light of changes in our business environment. By selling shares we deem no longer worth holding, we are working to reduce our number of cross-shareholdings.

(2) Reponses to items described in the annual securities report for the term ended March 2024

We are addressing the two items below with regard to our sustainability principles and initiatives described in the annual securities report for the term ended March 2024.

1. Response to climate change (information disclosure based on the TCFD recommendation)

2. Human capital and diversity

(3) Skills matrix of the board of directors

A skills matrix summarizes the skills of all directors in one chart. At our company, we strive to identify the skills of each director, ensure diversity, and disclose relevant information to our stakeholders.

Skills matrix of the board of directors

Reasons for selecting each skill

Remuneration Determination Policy

Remuneration Determination Policy

At the Board of Directors meeting on March 30, 2022, the Company resolved the following policy regarding the determination of individual director remuneration. We will continue to strive to enhance our governance framework.

- The remuneration for our executive directors (hereinafter referred to as “director remuneration”) shall be structured to serve as an incentive for each executive director to perform their duties in accordance with the Company’s management philosophy and to achieve sustainable enhancement of corporate value.

- To ensure a more objective and transparent process for determining director remuneration, a Nomination and Remuneration Committee shall be established as an advisory body to the Board of Directors. The Committee shall consist of a majority of independent outside directors.

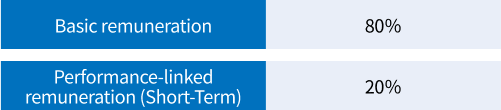

- Director remuneration shall be structured with an appropriate balance of fixed and performance-based components, ensuring that the remuneration level is suitable in light of each executive director’s rank, responsibilities, and performance.

- Fixed remuneration shall be provided in monetary form and disbursed on a monthly basis. The Nomination and Remuneration Committee shall deliberate on the appropriate amounts, taking into account the position and responsibilities of each executive director, and then submit its recommendations to the Board of Directors.

- Performance-based compensation shall be provided in monetary form and disbursed once per year. The Nomination and Remuneration Committee shall review factors such as the achievement rate against the target consolidated operating income for each fiscal year and the appropriateness of the ratio to fixed remuneration, and then submit its recommendations to the Board of Directors.

- When determining individual remuneration for executive directors, the President, who is delegated authority by the Board of Directors, shall determine the amounts within the range approved at the General Meeting of Shareholders. In making these decisions, the President shall respect the recommendations of the Nomination and Remuneration Committee.

- Remuneration for outside directors (excluding those serving as audit committee members) shall consist solely of fixed remuneration.

- The remuneration for directors serving as audit committee members shall be determined through consultation by the Audit Committee, within the range approved at the General Meeting of Shareholders.

Fujikura Kasei Co., Ltd.

President

Daisuke Kato

Guidelines for the Ratio of remuneration for Directors (Excluding Outside Directors)