Business Portfolio Management

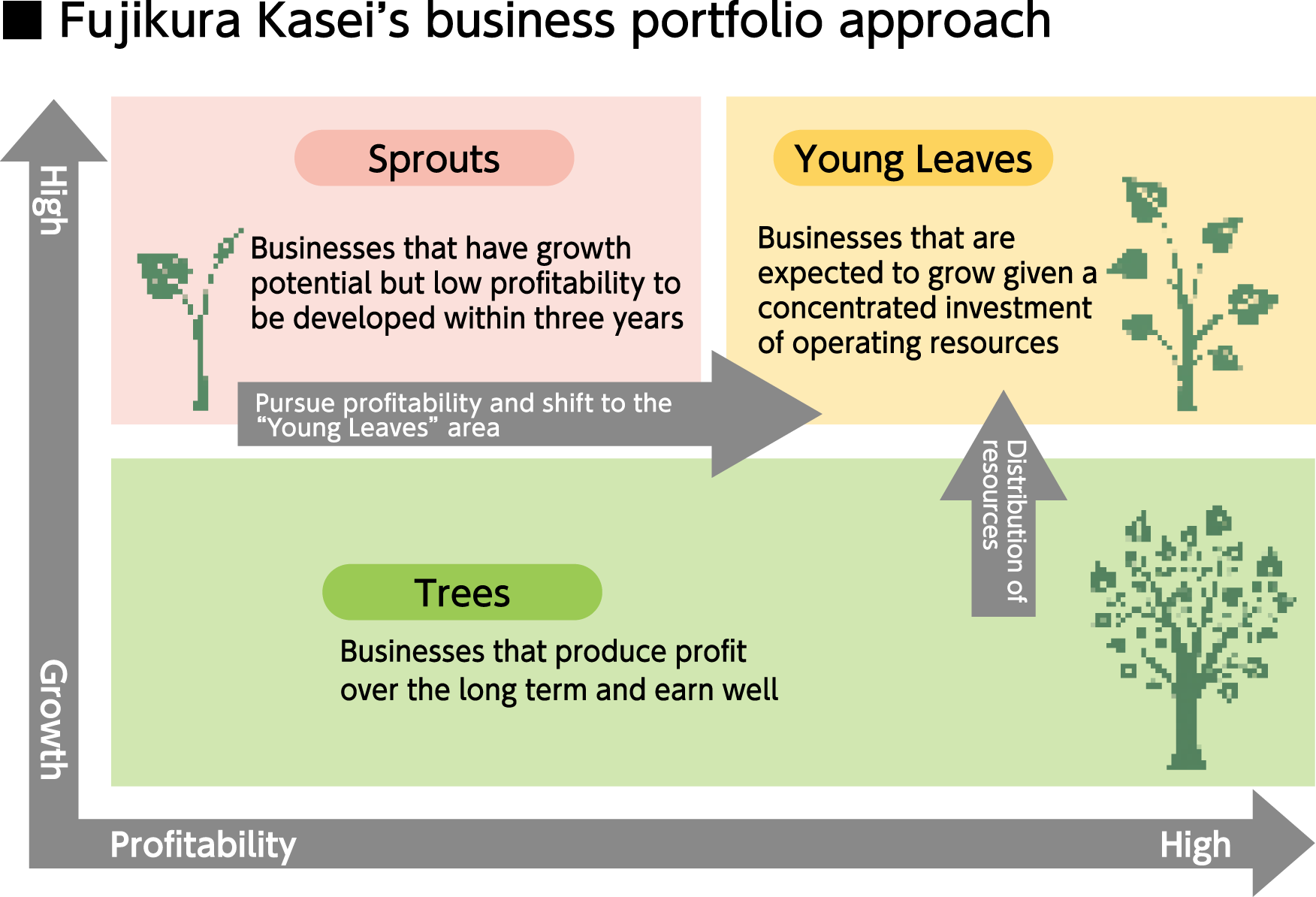

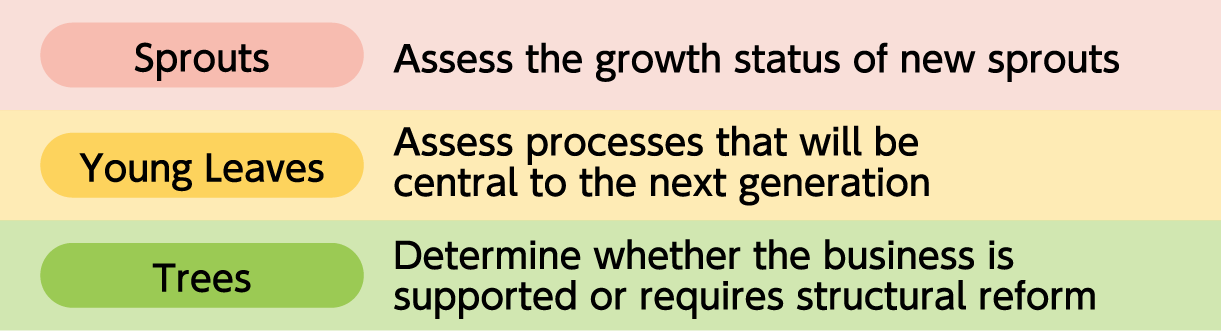

With the launch of the 11th mid-term management plan, Fujikura Kasei has introduced the business portfolio approach, defining three business area strategies (“Sprouts: Expand technical development,” “Young Leaves: Strengthen core businesses,” and “Trees: Increase the profitability of foundation businesses”) . In pursuing business in our five business segments, we develop and implement strategies for each Strategic Business Unit (SBU) according to these domains.

Initiatives of the business portfolio strategy

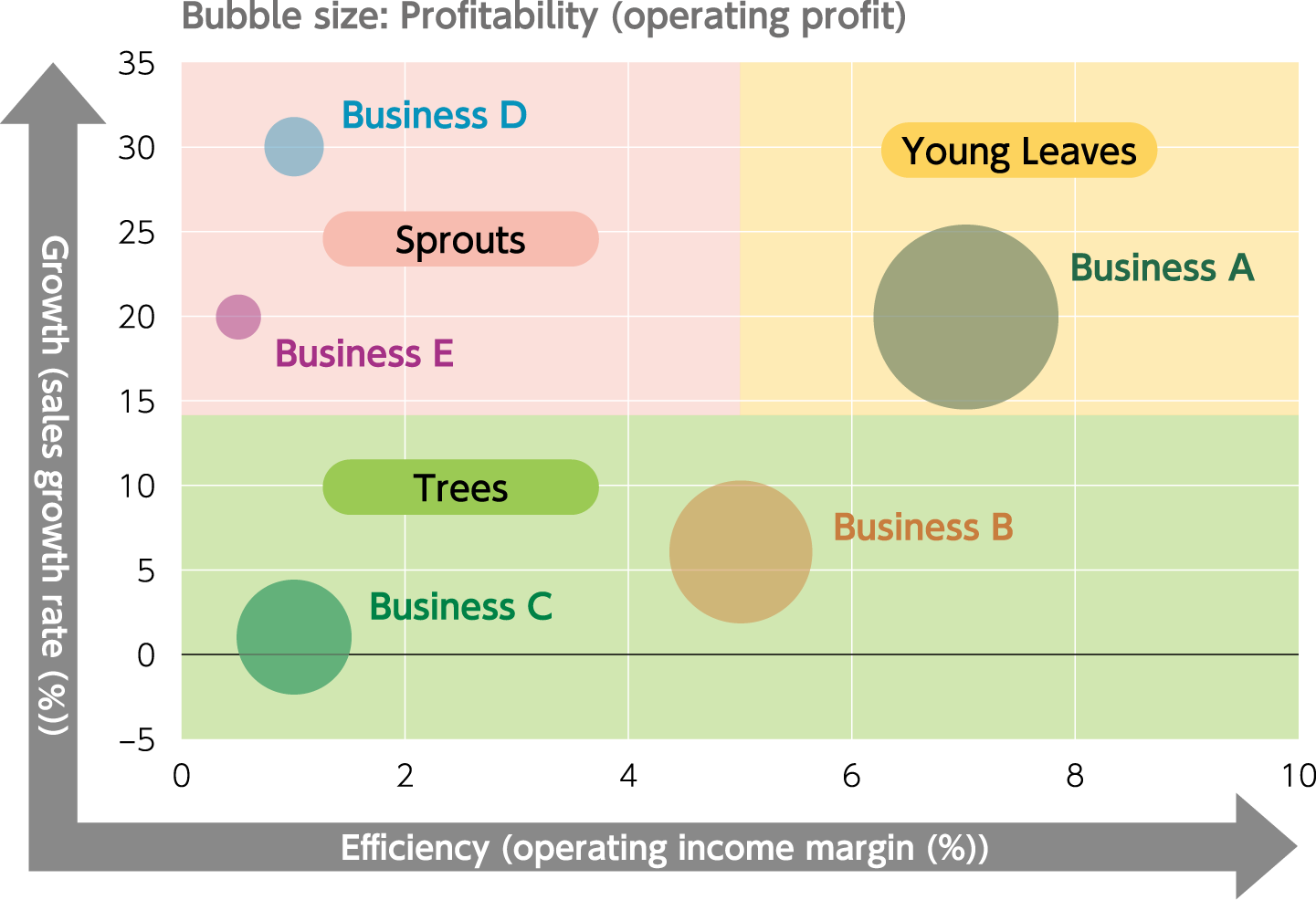

As a company-wide initiative beginning with the 11th mid-term management plan, we worked on visualizing our business portfolio according to a shared perspective, focusing on the three indices of “growth (sales growth rate),” “profitability (operating income),” and “efficiency (operating income margin).” So far, the three areas of “Sprouts,” “Young Leaves,” and “Trees” in the business portfolio strategy have frequently been considered in qualitative terms. Because each division had different perspectives and metrics for evaluation, there was a slight lack of objectivity. To produce results in the three business area strategies as outlined in the 11th mid-term management plan, all business segments, business divisions, Group companies, and the SBUs of product groups were quantified to allow them to be analyzed objectively. In the “Sprouts” and “Young Leaves” areas, we will set a path for the priority areas in each business segment, renew their business from a future perspective, and create new value toward achieving sustainable growth. In the “Trees” area, which relates directly to our company's performance, we will focus on increasing productivity and improving the earnings structure of all operations.

Business evaluation after introducing the business portfolio strategy

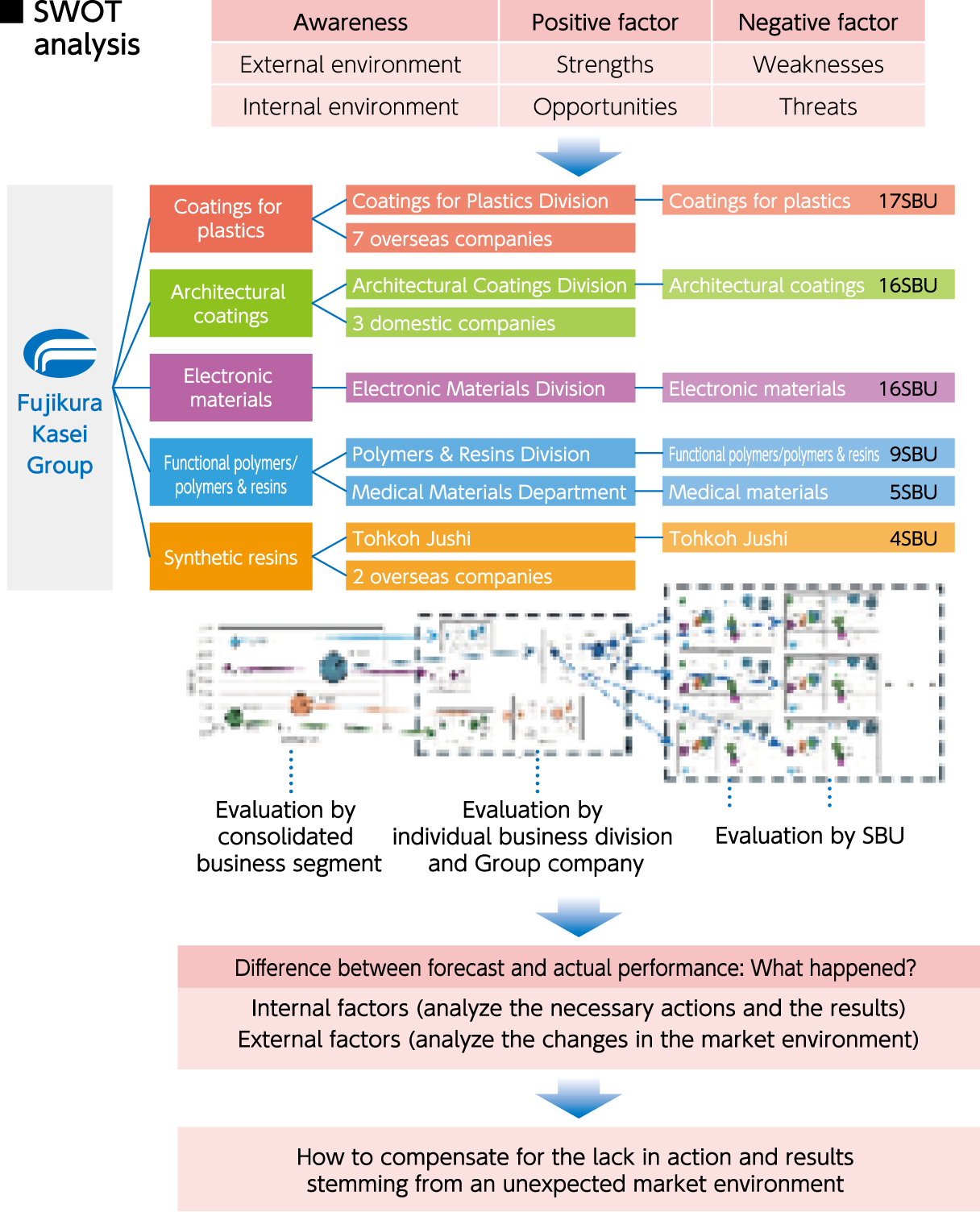

To achieve sustainable growth, we need to pursue profitability and determine the proper allocation of management resources for each of the three areas of “Sprouts,” “Young Leaves,” and “Trees.” Under the 11th mid-term management plan, we made company-wide efforts to visualize our business portfolio so we may evaluate our performance in quantitative terms. Until now, there was a strong tendency to focus on sales, but by visualizing our business portfolio, it has become possible to evaluate our business at the same level across the company. Beginning with each business segment, we evaluate performance in terms of individual divisions, consolidated Group companies, and down to the smallest SBU. First, we identify positive and negative factors in the external and internal environments using a SWOT analysis. Then, we evaluate earning power and growth quantitatively from the perspective of PPM (Product Portfolio Management). Additionally, for the results evaluated quantitatively, each business segment takes a bottom-up approach to gather qualitative information from each SBU. We review the reasons behind the outcome and plan our next actions toward future success.

Effects of visualizing the business portfolio strategy

Whether a target is achieved or not, visualization of the business portfolio has made it possible to assess target deviations objectively. These results are shared across the company, and corrections and compensation measures are promptly drafted so they may be addressed as management issues in the second year of the mid-term management plan.

Future initiatives

We will regularly evaluate our business based on a visualized business portfolio strategy and work to ensure that the results of these evaluations are understood at all levels of our organization. Additionally, we will make ongoing efforts to enhance corporate value by exploring avenues for quantitatively assessing the profitability of capital invested in each business segment and focusing on earning power.

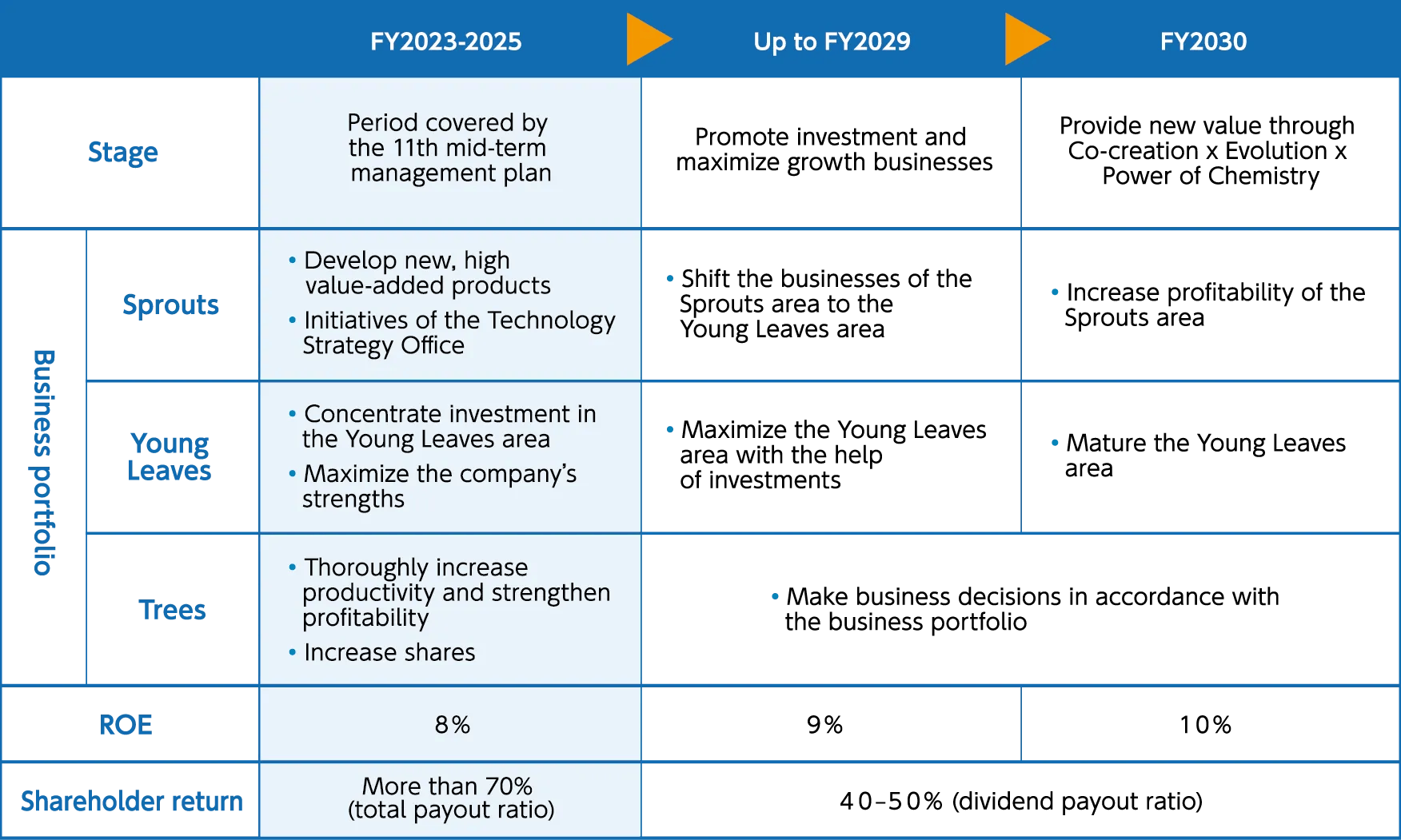

Stages to be achieved toward 2030